Earlier this year (May 2018), I had a personal finance epiphany. Out of nowhere I got this urge to get a hold of my finances and start aggressively paying off my $77,000 student loan debt and further educate myself on personal finance, financial independence, and investing.

During this epiphany I decided to plan how I could aggressively tackle my enormous student loan debt.

The baby step moment was to start budgeting.

I needed to understand where the heck my money was going. I could not figure out why I could not afford to pay more than I was paying. I started to budget. I wanted to make sure one month was not a fluke spending month so I figured I would expand the budget breakdown an extra month.

I currently spend literally a couple minutes per month on my budget using the free EveryDollar app. I use this app because of its simplicity. I do not like connecting any of my personal accounts to an app such as Mint and this budgeting app did not require that. I do not keep track of the expenses down to the cent. I want to spend as little amount of time budgeting so I round up conservatively and move on. That is all the time I want to spend.

I really simplified the way I budget.

Here are my simple ways to categorize a monthly budget

This is all after tax income so I do not budget any contributions made to pre tax retirement accounts.

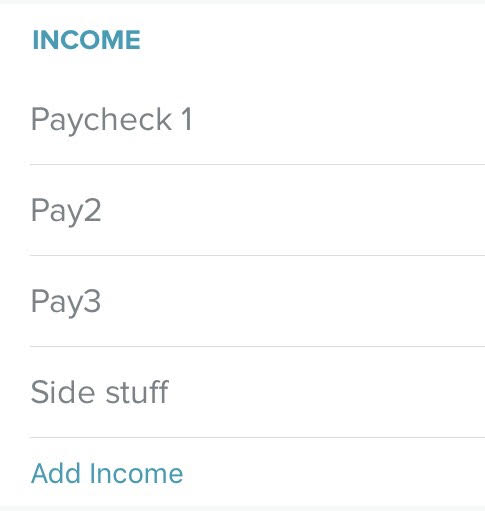

Income

- Any incoming money I have from my full time job and my side hustles. Pay3 was included because a couple months a year, I will get 3 paychecks based on the bi-weekly pay schedule.

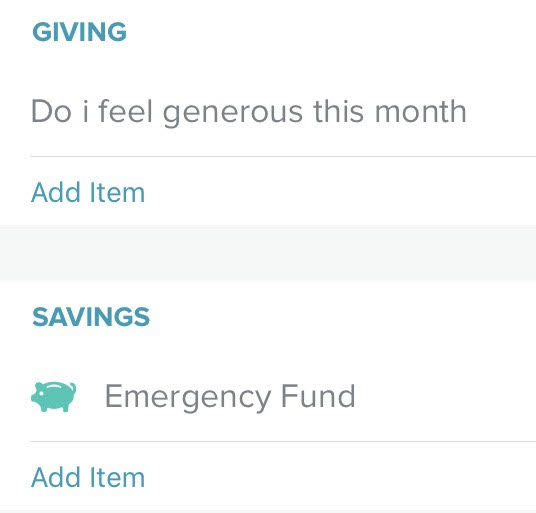

Giving

- I typically give to a charity (usually work sponsored or colleagues) a few times a year.

Savings

- Part of the “pay yourself first”. This one is a bit misleading since I have 2-3 months in emergency funds already. My pre-tax contributions are automated.

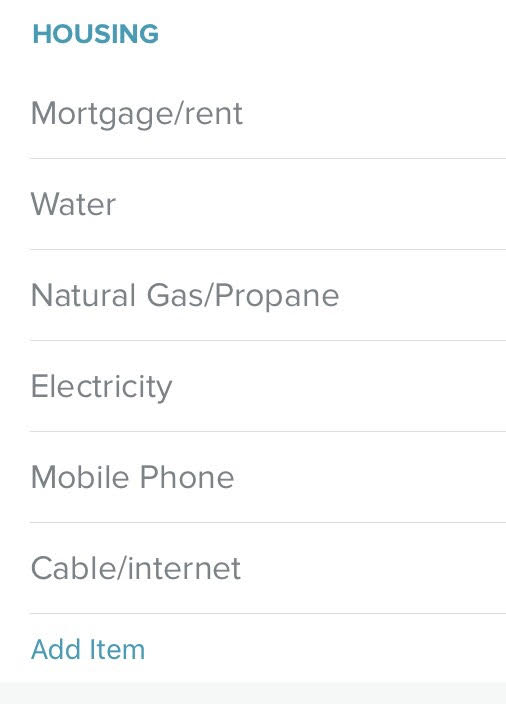

Housing

- Includes mortgage/rent expense and utilities. I also include my mobile wireless plan (I pay for my family’s 4 lines) as well as my internet. I do not and will never have cable.

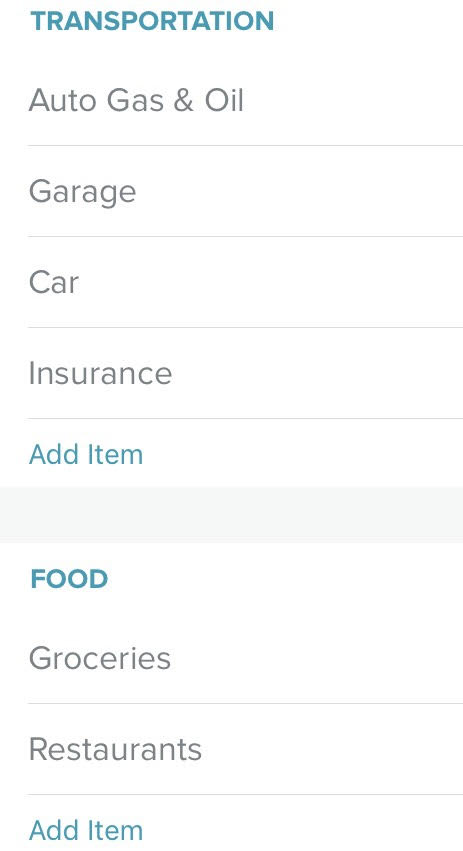

Transportation

- Most of these expenses are standard for most except for the garage. I live in the city and because I do not like to take public transportation (train, bus), I drive to work and pay a monthly parking garage fee. A waste of money? Sure, but this is a non negotiable.

Food

- This one is simple. Monthly groceries and eating out at restaurants. My restaurant expense is much higher than most because I typically buy lunch at work and do not pack my own lunch. Chalk that up to laziness or “paying for convenience.”

Lifestyle

- This covers a variety of sub categories as seen in my budgeting screenshot below. I do not have any subscriptions so I should take that out. I have post office in there because I buy and sell as a side hustle and need to ship items out. Resell is buying inventory that I will eventually flip.

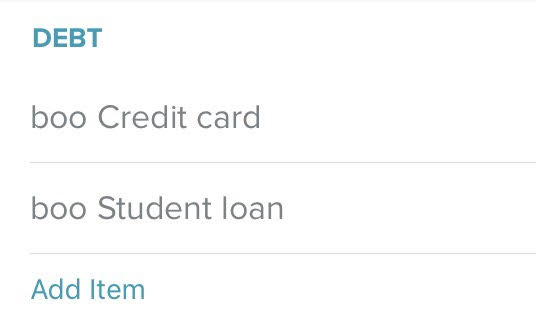

Debt

- Yes, I said “boo” below. I pay off my credit card debt in full every month to avoid paying any unnecessary interest. I still have student loan debt, but on track to pay off my student loan debt next year.