Book Recap Series: How to Invest in Real Estate by Brandon Turner, Joshua Dorkin

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: The ONE Thing by Gary Keller, Jay Papasan

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: The Tipping Point by Malcolm Gladwell

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: Think and Grow Rich by Napoleon Hill

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: How to Win Friends & Influence People by Dale Carnegie

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: The Richest Man in Babylon by George S. Clason

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Sports Cards Collection How To Inventory, Appraise, and Sell To Make Money

For those of us who have been in the sports cards industry whether full timeRead More…

4 Easy Financial Rules and Principles I Use to Increase My Net Worth

As I have crawled out of my terrible money situations in my 20s to beingRead More…

9 Work Habits and Tips I Wish I Knew When I Was In My 20s And Still Helpful Today

As I was thinking through the money tips I wish I knew, I started toRead More…

11 Money Habits and Tips I Wish I Knew When I Was In My 20s And Still Helpful Today

A while ago, I wrote a piece about a conversation I was having with aRead More…

4 Reasons I Decided Not To Transition My Sports Cards Hobby Into A Full Time Job

If you have ever been passionate about a certain hobby or side hustle, you haveRead More…

Podcast Episode 4 My Investment Buckets, Side Hustling, and Alternative Investment Strategy That Relies On Sports Cards

I wanted to give an introduction to my overall investment approach and start digging intoRead More…

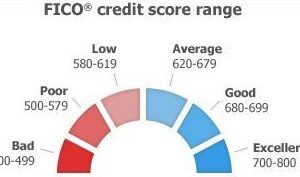

How I Raised My FICO Credit Score From 500 to A Near Perfect 850 Credit Score

It took me 8-10 years to crawl out of the lowest point in my FICORead More…

My Marketing Career Journey Leading to Becoming a Vice President of Digital Marketing and Career Lessons Learned Along The Way

Many people have reached out throughout my career especially in the past several years askingRead More…

My Second SWOT Financial Analysis Strengths and Weaknesses

In 2018 I completed my 1st SWOT financial analysis focusing on my financial strengths, weaknesses,Read More…

Interview with James AKA Awe_SomeProCards and How Nostalgia Kept Him In Sports Cards and Continuing to Learn About the Hobby

I’m very excited to share interviews conducted with several sports cards hobbyists, enthusiasts, champions, andRead More…

Interview with Agostino AKA A&M Centerpiece Sports Cards Investments and Lesson Learned Buying, Grading, and Selling a 2001 Bowman Chrome Albert Pujols Auto

I’m very excited to share interviews conducted with several sports cards hobbyists, enthusiasts, champions, andRead More…

Interview with Kyle AKA KWJ Sports Cards And Several Ways to Make Money With Sports Cards

I’m very excited to share interviews conducted with several sports cards hobbyists, enthusiasts, champions, andRead More…

Interview with Ron, Founder of a 27,000 Member Facebook Sports Cards Scammers Group and How $25 Saved Countless Number of Collectors

I’m very excited to share interviews conducted with several sports cards hobbyists, enthusiasts, champions, andRead More…

Interview with Jon The Basketball Card Guy, Buying or Investing in What You Know and A Warning to Those Who Think Market Values Are eBay Values

I’m very excited to share interviews conducted with several sports cards hobbyists, enthusiasts, champions, andRead More…