Podcast Episode 2 Sharing My Embarrassing Money Moron Moments and How Podcasts Saved My Financial Life

Although my About OMG My Money page has details on my personal finance journey, IRead More…

Best Ways to Pay Off Student Loans Faster

I am very excited to have this guest post from Rakshitha.N, a financial writing expert. ContactRead More…

A Look Back One Year Later After Paying Off My $77,000 Student Loan Debt and Becoming Debt Free

Over a year ago, I became debt free by paying off my massive $77,000 studentRead More…

How The Debt Avalanche Method Can Help to Pay Off Your Debts

I am very excited to have this guest post from financial writer, Good Nelly. ContactRead More…

How I Stayed Motivated To Pay Off My Massive Student Loan Debt

During my journey to pay off my massive student loan debt, the toughest thing forRead More…

How I Paid My $77,000 Student Loan Debt

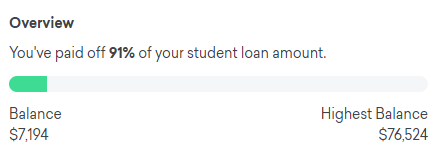

$76,524.22 was the exact student loan debt amount I fully paid off. I wanted toRead More…

My $77,000 Student Loans Are Fully Paid Off After Defaulting!

I fully paid off $77,000 ($76,524.22 to be exact) in student loans! If you wantRead More…

Getting Closer to Paying off My $77,000 Student Loan Debt Payoff December Progress Update

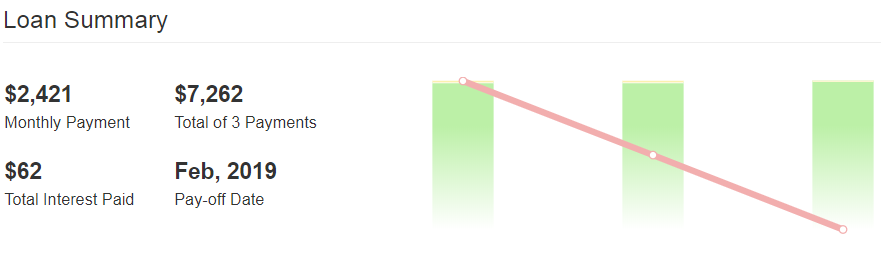

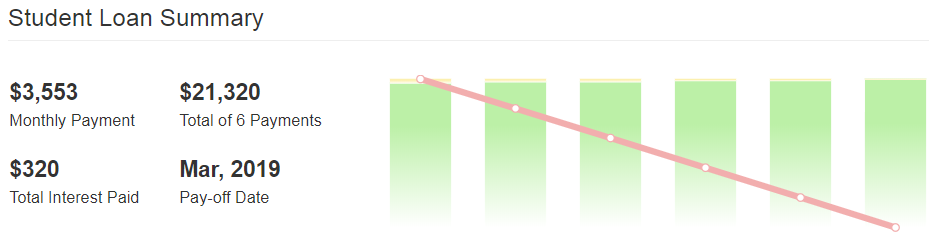

Thanks to a variety of personal finance and side hustle podcasts, I have been motivatedRead More…

My 5 Biggest Money Mistakes

I have made some of the worst money mistakes any person can make. It tookRead More…

My $77,000 Student Loan Debt Payoff November Progress Update

Ever since I set my student loan debt payoff goal of March 2019, I haveRead More…

My $77,000 Student Loan Debt Payoff Goal March 2019

Back in July (2018), I wrote a post about getting motivated to pay off myRead More…

My 3 Year Financial Plan

I have to admit, the older I get the less I want to think aboutRead More…

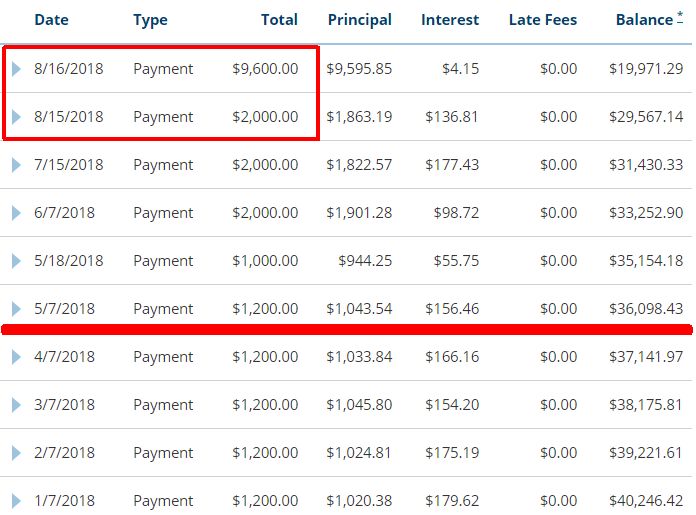

My $77,000 Student Loan Debt Progress as of August 2018

I am sure you have seen the articles about how the average college graduate hasRead More…

11 Biggest Debt Traps

What are some of the biggest debt traps? The word debt is about as cringeRead More…

My 9 Top Money Saving Rules

What are your favorite top money rules that you (try to) follow? I referenced blogRead More…

One of the Best Ways to Get An Extra Income

What are your favorite side hustling gigs? I would love to explore new side hustleRead More…

Getting Motivated to Accelerate Paying off My Student Loan Debt

In my 20’s I ignored my massive student loan debt and eventually went into default.Read More…

Top 3 Things I Would Do Differently When Applying to College

I made financial mistakes. Cringe worthy financial mistakes. Admittedly voluntary because I had no financialRead More…

Top 5 Financial Considerations If Applying to a Four Year University

What I write in this post is purely from my own experiences. I am notRead More…

A Money Finance Blog – Beginnings of a Money Moron

I am a money moron. I REALLY am. I kid you not. Hear me out.Read More…