Podcast Episode 2 Sharing My Embarrassing Money Moron Moments and How Podcasts Saved My Financial Life

Although my About OMG My Money page has details on my personal finance journey, IRead More…

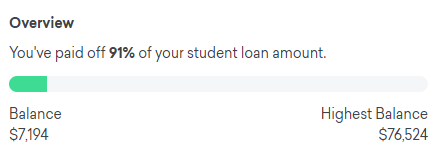

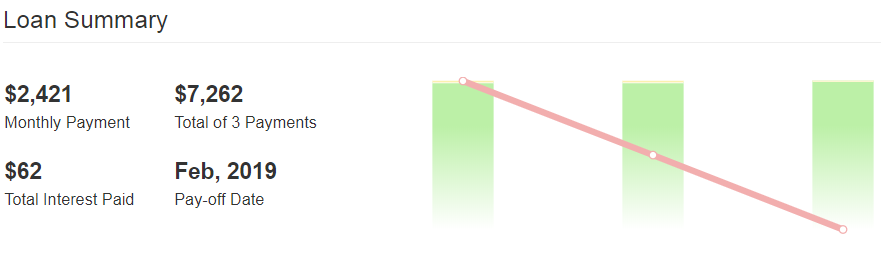

Getting Closer to Paying off My $77,000 Student Loan Debt Payoff December Progress Update

Thanks to a variety of personal finance and side hustle podcasts, I have been motivatedRead More…

My 5 Biggest Money Mistakes

I have made some of the worst money mistakes any person can make. It tookRead More…

My $77,000 Student Loan Debt Payoff November Progress Update

Ever since I set my student loan debt payoff goal of March 2019, I haveRead More…

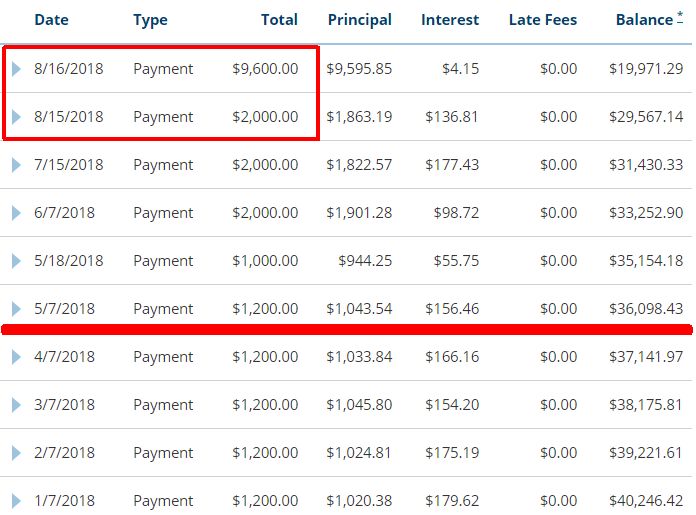

My $77,000 Student Loan Debt Progress as of August 2018

I am sure you have seen the articles about how the average college graduate hasRead More…

Why I Am Happy I Chose to Attend An Out of State Big 10 University

As a self professed money moron (I was and partially still am), attending an outRead More…

Getting Motivated to Accelerate Paying off My Student Loan Debt

In my 20’s I ignored my massive student loan debt and eventually went into default.Read More…

Why I Regret Going to An Out of State Big 10 University

Let me start off by saying that my regret going to a four year BigRead More…

Top 3 Things I Would Do Differently When Applying to College

I made financial mistakes. Cringe worthy financial mistakes. Admittedly voluntary because I had no financialRead More…

Top 5 Financial Considerations If Applying to a Four Year University

What I write in this post is purely from my own experiences. I am notRead More…