Book Recap Series: How to Invest in Real Estate by Brandon Turner, Joshua Dorkin

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: Think and Grow Rich by Napoleon Hill

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: How to Win Friends & Influence People by Dale Carnegie

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

Book Recap Series: The Richest Man in Babylon by George S. Clason

These book recap series posts are simply my way of jotting down important takeaways fromRead More…

4 Easy Financial Rules and Principles I Use to Increase My Net Worth

As I have crawled out of my terrible money situations in my 20s to beingRead More…

9 Work Habits and Tips I Wish I Knew When I Was In My 20s And Still Helpful Today

As I was thinking through the money tips I wish I knew, I started toRead More…

11 Money Habits and Tips I Wish I Knew When I Was In My 20s And Still Helpful Today

A while ago, I wrote a piece about a conversation I was having with aRead More…

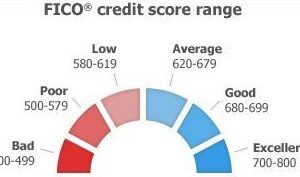

How I Raised My FICO Credit Score From 500 to A Near Perfect 850 Credit Score

It took me 8-10 years to crawl out of the lowest point in my FICORead More…

My Second SWOT Financial Analysis Strengths and Weaknesses

In 2018 I completed my 1st SWOT financial analysis focusing on my financial strengths, weaknesses,Read More…

Podcast Episode 2 Sharing My Embarrassing Money Moron Moments and How Podcasts Saved My Financial Life

Although my About OMG My Money page has details on my personal finance journey, IRead More…

Best Ways to Pay Off Student Loans Faster

I am very excited to have this guest post from Rakshitha.N, a financial writing expert. ContactRead More…

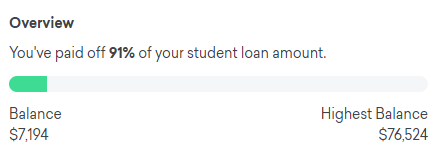

A Look Back One Year Later After Paying Off My $77,000 Student Loan Debt and Becoming Debt Free

Over a year ago, I became debt free by paying off my massive $77,000 studentRead More…

How The Debt Avalanche Method Can Help to Pay Off Your Debts

I am very excited to have this guest post from financial writer, Good Nelly. ContactRead More…

How I Stayed Motivated To Pay Off My Massive Student Loan Debt

During my journey to pay off my massive student loan debt, the toughest thing forRead More…

How I Paid My $77,000 Student Loan Debt

$76,524.22 was the exact student loan debt amount I fully paid off. I wanted toRead More…

3 Reasons I am Niche-ing Down On This Personal Finance Blog

I recently decided to niche down on my personal finance blog. I started this blogRead More…

5 Dumb Excuses I Made For Not Saving Money

I made some dumb financial mistakes in my 20s such as defaulting on my studentRead More…

7 Tips About Using 0% Financing from a Credit Card Marketer

I am sure most of you have come across a 0% financing offer typically whenRead More…

Getting Closer to Paying off My $77,000 Student Loan Debt Payoff December Progress Update

Thanks to a variety of personal finance and side hustle podcasts, I have been motivatedRead More…

7 Reasons You Should Have a Side Hustle to Make Extra Money

Having a side hustle to make more money is a great way to achieve yourRead More…