11 Money Habits and Tips I Wish I Knew When I Was In My 20s And Still Helpful Today

A while ago, I wrote a piece about a conversation I was having with aRead More…

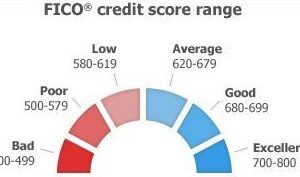

How I Raised My FICO Credit Score From 500 to A Near Perfect 850 Credit Score

It took me 8-10 years to crawl out of the lowest point in my FICORead More…

Podcast Episode 2 Sharing My Embarrassing Money Moron Moments and How Podcasts Saved My Financial Life

Although my About OMG My Money page has details on my personal finance journey, IRead More…

How The Debt Avalanche Method Can Help to Pay Off Your Debts

I am very excited to have this guest post from financial writer, Good Nelly. ContactRead More…

5 Dumb Excuses I Made For Not Saving Money

I made some dumb financial mistakes in my 20s such as defaulting on my studentRead More…

7 Tips About Using 0% Financing from a Credit Card Marketer

I am sure most of you have come across a 0% financing offer typically whenRead More…

Pull Your Free Annual Credit Report Before the End of the Year

This is a public service announcement and reminder to pull one of your creditRead More…

4 Things to Look For on Your Credit Report

As the year comes to an end, it is important to take advantage of theRead More…

My 5 Biggest Money Mistakes

I have made some of the worst money mistakes any person can make. It tookRead More…

6 Bad Financial Habits That You Need to Monitor

All of us have bad financial habits, right? I had some horrific financial habits inRead More…

11 Biggest Debt Traps

What are some of the biggest debt traps? The word debt is about as cringeRead More…

My 9 Top Money Saving Rules

What are your favorite top money rules that you (try to) follow? I referenced blogRead More…

A Money Finance Blog – Beginnings of a Money Moron

I am a money moron. I REALLY am. I kid you not. Hear me out.Read More…

I started a finance blog. Welcome to my first post

Welcome to my finance blog. Yes, I am a money moron. Really. You should checkRead More…