4 Easy Financial Rules and Principles I Use to Increase My Net Worth

As I have crawled out of my terrible money situations in my 20s to beingRead More…

11 Money Habits and Tips I Wish I Knew When I Was In My 20s And Still Helpful Today

A while ago, I wrote a piece about a conversation I was having with aRead More…

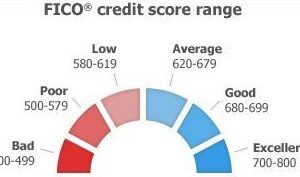

How I Raised My FICO Credit Score From 500 to A Near Perfect 850 Credit Score

It took me 8-10 years to crawl out of the lowest point in my FICORead More…

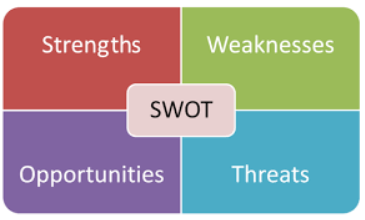

My Second SWOT Financial Analysis Strengths and Weaknesses

In 2018 I completed my 1st SWOT financial analysis focusing on my financial strengths, weaknesses,Read More…

Podcast Episode 2 Sharing My Embarrassing Money Moron Moments and How Podcasts Saved My Financial Life

Although my About OMG My Money page has details on my personal finance journey, IRead More…

Best Ways to Pay Off Student Loans Faster

I am very excited to have this guest post from Rakshitha.N, a financial writing expert. ContactRead More…

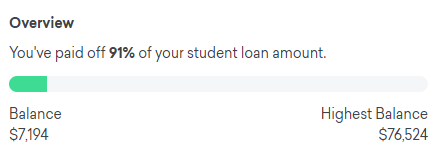

A Look Back One Year Later After Paying Off My $77,000 Student Loan Debt and Becoming Debt Free

Over a year ago, I became debt free by paying off my massive $77,000 studentRead More…

How The Debt Avalanche Method Can Help to Pay Off Your Debts

I am very excited to have this guest post from financial writer, Good Nelly. ContactRead More…

How I Paid My $77,000 Student Loan Debt

$76,524.22 was the exact student loan debt amount I fully paid off. I wanted toRead More…

My $77,000 Student Loans Are Fully Paid Off After Defaulting!

I fully paid off $77,000 ($76,524.22 to be exact) in student loans! If you wantRead More…

5 Dumb Excuses I Made For Not Saving Money

I made some dumb financial mistakes in my 20s such as defaulting on my studentRead More…

7 Tips About Using 0% Financing from a Credit Card Marketer

I am sure most of you have come across a 0% financing offer typically whenRead More…

Getting Closer to Paying off My $77,000 Student Loan Debt Payoff December Progress Update

Thanks to a variety of personal finance and side hustle podcasts, I have been motivatedRead More…

6 Ways to Build Credit to Improve Your Credit Score

There are some financial “entertainers” who believe that building credit and building your FICO creditRead More…

4 Simple Money Advice I Gave to a Colleague in Their 20s

Recently I was talking to a colleague in her 20s and we started to talkRead More…

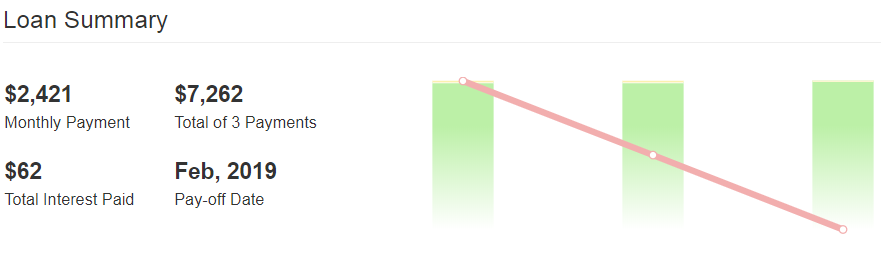

My $77,000 Student Loan Debt Payoff November Progress Update

Ever since I set my student loan debt payoff goal of March 2019, I haveRead More…

I Knocked Off a Sports Bucket List Item and Went to the World Series Again

I was on a pretty good roll with putting posts up on this blog sinceRead More…

5 Actions I Will Not Be Cheap About

I genuinely believe that if you are just starting to plan for your future whetherRead More…

7 Actions That Can Cost You Time And Money in the Long Run

As I started to spend a couple minutes every month budgeting, I noticed a patternRead More…

My Simple Way of Budgeting and Budget Categories

Earlier this year (May 2018), I had a personal finance epiphany. Out of nowhere IRead More…