Podcast Episode 2 Sharing My Embarrassing Money Moron Moments and How Podcasts Saved My Financial Life

Although my About OMG My Money page has details on my personal finance journey, IRead More…

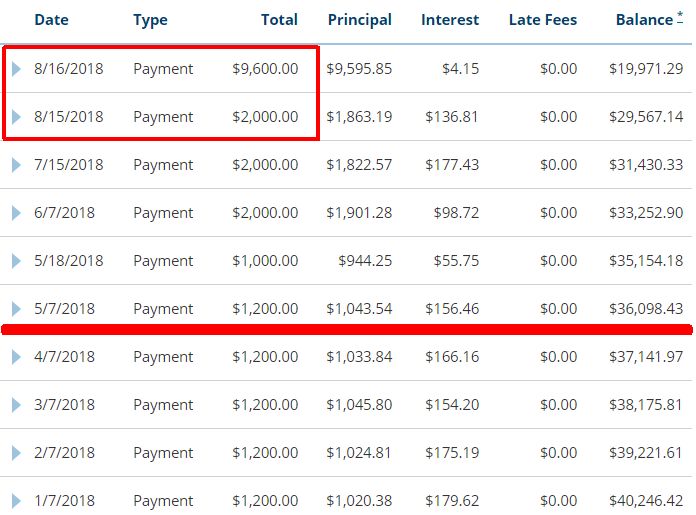

My $77,000 Student Loans Are Fully Paid Off After Defaulting!

I fully paid off $77,000 ($76,524.22 to be exact) in student loans! If you wantRead More…

5 Dumb Excuses I Made For Not Saving Money

I made some dumb financial mistakes in my 20s such as defaulting on my studentRead More…

My 5 Biggest Money Mistakes

I have made some of the worst money mistakes any person can make. It tookRead More…

I Knocked Off a Sports Bucket List Item and Went to the World Series Again

I was on a pretty good roll with putting posts up on this blog sinceRead More…

Kevin Hart Has One of the Best Financial Advice Stay in Your Financial Lane

I enjoy my share of stand up comedy performances. One of my favorites has beenRead More…

August 2018 Post Recap

Last month (August 2018) I posted 15 total blog posts, slightly lower than the 21Read More…

My $77,000 Student Loan Debt Progress as of August 2018

I am sure you have seen the articles about how the average college graduate hasRead More…

I Really Told Myself That I Expect to Have a Car Payment Forever

Just as recently as January 2017, one of my good colleagues and I were havingRead More…

What Should I Do With Extra Emergency Funds

I recently started questioning where I should stash my emergency fund. The past several years,Read More…

The 9 Lamest Excuses I Made For Not Saving Money

Throughout this journey I am on as a money moron, self reflection made me realizeRead More…

It Must Have Been a Sign When I Failed to Buy a House

I might have been going down the path of another money moron moment that perhapsRead More…

11 Biggest Debt Traps

What are some of the biggest debt traps? The word debt is about as cringeRead More…

Confessions of a Money Moron My Top 4 Guilty Pleasures

Everyone has guilty pleasures. Whether you are struggling financially and living off paycheck to paycheckRead More…

I Am a Money Moron with My Monthly Transportation Expenses

Cue Usher’s “Confessions” melody….these are my confessions….for being a money moron to this day. IRead More…

Why I Regret Going to An Out of State Big 10 University

Let me start off by saying that my regret going to a four year BigRead More…

Top 5 Financial Considerations If Applying to a Four Year University

What I write in this post is purely from my own experiences. I am notRead More…

A Money Finance Blog – Beginnings of a Money Moron

I am a money moron. I REALLY am. I kid you not. Hear me out.Read More…