I am sure you have seen the articles about how the average college graduate has a 5 figure student loan debt amount. Here is an article from CNBC for a refresher.

I ended up owing a 6 figure student loan debt upon graduation and defaulted. Fast forward more than 10 years and I still owed the US Department of Education nearly $77,000 total.

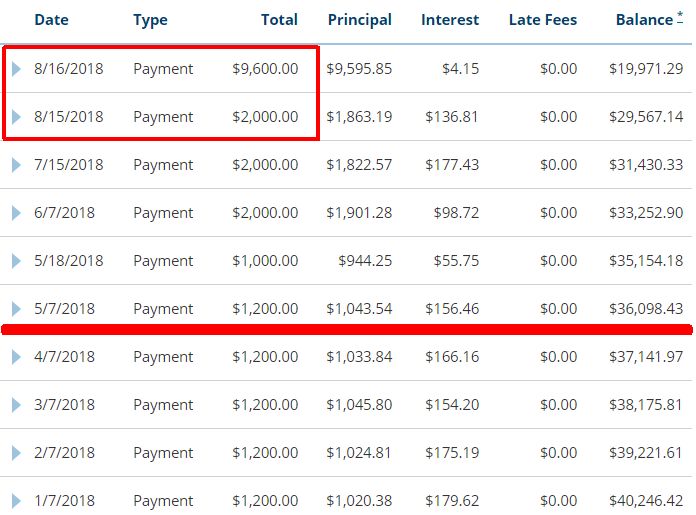

The minimum monthly payment on my student loan debt is $826.24. For the past several years, I started paying $1,200 per month.

Beginning May 2018 I started this blog and went on a personal finance journey. I started listening to personal finance podcasts nonstop like an insane person. Seriously, I have a slight case of FOMO so I will start every new podcast I listen to from episode 1, if available, and I will listen non stop while taking notes on my phone.

I started spending a few minutes a month to ballpark and estimate my monthly budget.

I soon realized that I can easily cut some financing fat and increase my monthly payment from $1,200 per month to $2,000 per month.

I also reduced my contribution through my company’s retirement account from 15% down to 0% despite my company offering a 401k match. I listened to one of the financial advices that Dave Ramsey consistently gives, which was to give up all retirement account contributions until debt (not including mortgage) was paid off. Why would anyone ever give up free money. After a month of heeding to this advice, I immediately ramped up my retirement contributions to just my company 401k match.

As of just earlier this month (August 2018), I took a chunk of my extra emergency funds and put it into my student loan debt. This excess amount was just sitting in a high yield savings account for literally a decade. Money moron right?

I am now at a $20,000 student loan balance with a target pay off date in 10 months assuming I continue to pay around $2,000 a month. As mentioned in an earlier post, I am aiming to focus on my side hustle to expedite paying off my student loan debt and increasing my current monthly payment from $2,000 a month to at least $2,200 a month.

I am aiming to pay off another big chunk in September if all goes well and I will post a student loan debt repayment update end of September.

Here is to the long journey of fixing all the financial mistakes I made in my 20s to almost being debt free. I can smell it.