Best Ways to Pay Off Student Loans Faster

I am very excited to have this guest post from Rakshitha.N, a financial writing expert. ContactRead More…

A Look Back One Year Later After Paying Off My $77,000 Student Loan Debt and Becoming Debt Free

Over a year ago, I became debt free by paying off my massive $77,000 studentRead More…

How The Debt Avalanche Method Can Help to Pay Off Your Debts

I am very excited to have this guest post from financial writer, Good Nelly. ContactRead More…

How I Stayed Motivated To Pay Off My Massive Student Loan Debt

During my journey to pay off my massive student loan debt, the toughest thing forRead More…

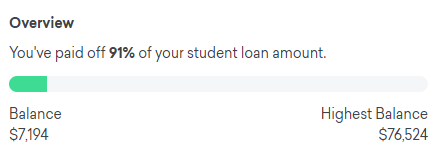

How I Paid My $77,000 Student Loan Debt

$76,524.22 was the exact student loan debt amount I fully paid off. I wanted toRead More…

My $77,000 Student Loans Are Fully Paid Off After Defaulting!

I fully paid off $77,000 ($76,524.22 to be exact) in student loans! If you wantRead More…

7 Tips About Using 0% Financing from a Credit Card Marketer

I am sure most of you have come across a 0% financing offer typically whenRead More…

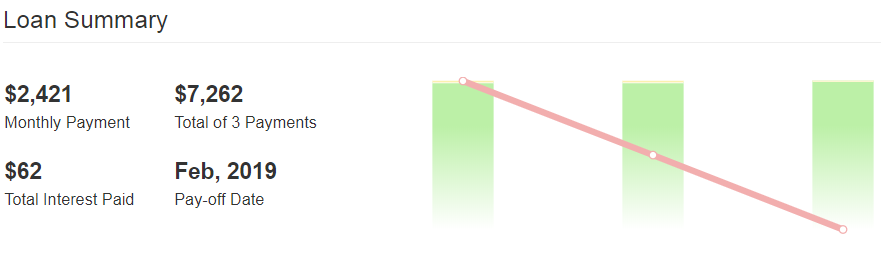

Getting Closer to Paying off My $77,000 Student Loan Debt Payoff December Progress Update

Thanks to a variety of personal finance and side hustle podcasts, I have been motivatedRead More…

7 Reasons You Should Have a Side Hustle to Make Extra Money

Having a side hustle to make more money is a great way to achieve yourRead More…

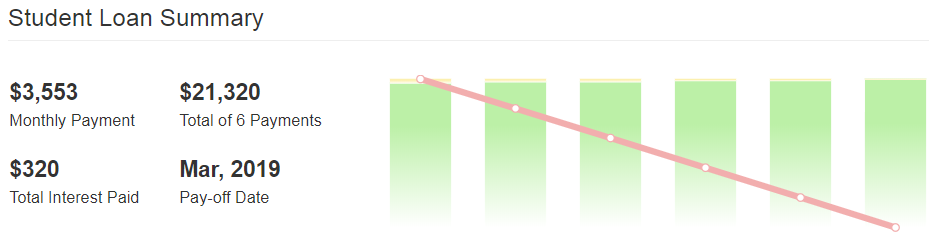

My $77,000 Student Loan Debt Payoff November Progress Update

Ever since I set my student loan debt payoff goal of March 2019, I haveRead More…

OMG Favorite Personal Finance Blog Posts of the Week Featuring Debt Experience vs Debt Knowledge, Procrastination, and Ego

For this week I rounded up the following blog posts that I enjoyed reading. OMGRead More…

My $77,000 Student Loan Debt Payoff Goal March 2019

Back in July (2018), I wrote a post about getting motivated to pay off myRead More…

11 Biggest Debt Traps

What are some of the biggest debt traps? The word debt is about as cringeRead More…

My 9 Top Money Saving Rules

What are your favorite top money rules that you (try to) follow? I referenced blogRead More…

Why I Am Happy I Chose to Attend An Out of State Big 10 University

As a self professed money moron (I was and partially still am), attending an outRead More…

Getting Motivated to Accelerate Paying off My Student Loan Debt

In my 20’s I ignored my massive student loan debt and eventually went into default.Read More…