In my 20’s I ignored my massive student loan debt and eventually went into default. One of the worst possible things financially you can do. I went into default only a few years out of college.

This is the reason I started this personal finance blog. For cringeworthy money moron moments, give the post a look for a quick rundown of my financial mistakes. I experienced credit cards getting cancelled, paying a crazy interest rate on car leases, and on and on.

Now in my 30s, I started paying off my credit card debt in full every month, I started contributing to my company’s 401K and aggressively putting more into a Roth IRA. However, I still had this massive student loan debt.

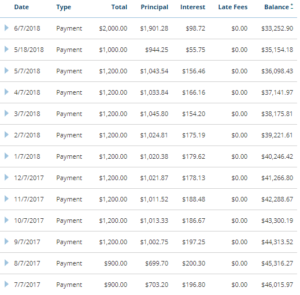

My minimum monthly student loan payment is $826.30. I started paying a little more than the minimum monthly requirement several years ago.

Just recently this year (2018) I started listening to personal finance podcasts. Some of the podcasts had guests who would share their debt payoff story.

What was really motivating for me hearing these stories was that some of these people (single, family, couples) were making less than the 6 figures I make now, were saving more than I was, AND were paying off their debt (credit card, student loan) more quickly.

This was mind blowing. I was amazed. If they can do it, I can too. It was really that simple. They are making less than me, have more debt, and paying off the debt quicker. Why am I so lazy and so uninformed. WTF!

Here is a look at my actual student loan debt payment history. I was paying $900 a month, which is a little over the $826.30 minimum monthly payment. In the later part of 2017, I starting increasing my monthly payment to $1,200. Notice that just a couple months ago, I started increasing my monthly payment to at least $2,000. That month is exactly the month I got super motivated thanks to the variety of podcasts.

I have a side hustle of buying and selling sports trading cards. The problem I have to this day (and a money moron moment) is that when I buy a sports cards collection, I get attached to many of the cards and only end up selling a few cards here and there. I am a speculative “investor” in baseball prospects so the fear of missing out (FOMO) is real.

My goal is to put at least an extra $200 a month from the side hustle towards the debt so I can increase my monthly payment from $2,000 to $2,200 beginning this month (July 2018). If I pay at my current rate of $2,000 per month, then I should pay off my (rounding up) $34K debt by Dec 2019. That is frightening. I am stressed just thinking about that.

Hopefully I can increase my monthly payment to $3,000 a month somehow, someway to pay off my debt by this time next year. I do have emergency savings stashed in a high yield savings account as well as a real estate investing fund that I am thinking of putting towards the student loan debt. I am hoping to simply save more every month, take my side hustle more seriously, and not touch any of my other funds.