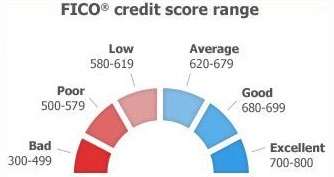

It took me 8-10 years to crawl out of the lowest point in my FICO credit score career from well below 500 to getting above 700 and then another couple years to sniff a near perfect 850 credit score.

I made many money moron mistakes in my 20s that deservedly made my credit score bottom out mainly defaulting on student loans. I paid for it by paying incredibly high interest rates on auto financing loans and generally being viewed as a very risky borrower.

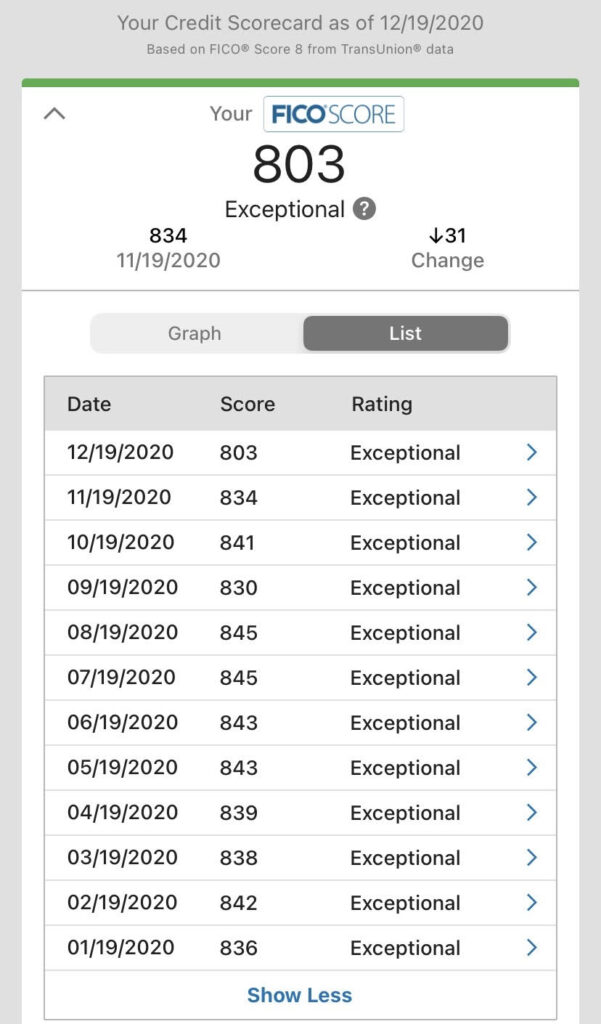

As I stated in a past post, I do not think there is much value of having a FICO credit score above 760 based on various sources. For those perfectionists, I want to share some tips on how I eventually got to an exact score of 845 (5 shy of a perfect 850 credit score). When I was struggling with my finances in my 20s and experiencing sub-500 credit scores, one of my finance goals was to be in the 800 FICO credit score club mainly because of how much I could potentially save on interest by having an exceptional credit score.

(Note: towards the end of November 2020 and into early December, I applied for conventional financing mortgages to buy an investment property and you can see how much of a hit I took.)

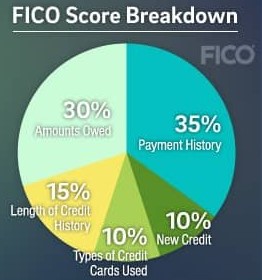

FICO Credit Score Breakdown

Here is a guideline by FICO of how the FICO credit score is broken down:

Payment history – 35%

Credit utilization/amounts owed – 30%

Length of credit history – 15%

New credit – 10%

Types of credit cards used/credit mix – 10%

7 Actions I Took To Improve My Credit Score

1. Pull and Review Your Credit Report From One Credit Bureau Once Every Quarter

Before COVID-19 you could pull the annual credit report once per year for each of the 3 reporting credit bureaus (Experian, TransUnion, Equifax). I would pull one of the 3 credit bureau reports around March-April, another one August-September, and the last one in December. During these COVID-19 times, annualcreditreport.com allows you to pull weekly reports.

What you will see in each credit report will not be exactly the same so you will want to review thoroughly.

2. Identify Credit Report Errors, Inaccuracies, and Opportunities To Fix

I personally have not experienced any glaring mistakes on my credit report, but I did find an opportunity to fix a missed payment. As noted in the FICO credit score breakdown above, your payment history is the most important factor in your credit score. Any indication of a missed payment will ding your credit score.

In my situation, I had an auto lease and I noticed that the credit bureau marked one of my payments as past due. What I did was I wrote a letter to the auto lease financing company about this missed payment and asked to change this to an on time payment. I had to write to the company a couple times and it worked! The financing company reported the correction to an on time payment.

Not all financing companies will be as generous, but I figured I had nothing to lose. The great community within the myFICO forums was key to knowing that the financing company I was working with presented a more optimistic chance of a missed payment reversal.

3. No Late Payments, Never Miss A Payment

I talk from experience. One missed payment will ding your credit score. Several missed payments will crush your credit score. Having your missed payments go into collection will kill your credit score. Having those collections go into default will dig your credit score into a grave. I experienced every single one of these scenarios, which is why my credit score dropped to below 500.

Never miss a payment. I cannot emphasize this enough. This is very easy to overlook especially if you do not make automated payments. If you still send manual payments in the form of a check or go into the servicing site to manually pay a bill, you are setting yourself up for a possible missed payment.

I recommend automating payments as much as possible to make your life more stress free.

4. Keep Your Credit Usage Low

Credit utilization is important to keep track. I used to aim for 10% credit utilization or below, but nowadays I rarely go over 1%. As an example if you use the 10% guideline and you have a $10,000 credit limit combined, you should be limiting your credit spend to $1,000 or below. I personally put thousands of dollars every month on a credit card, but I always pay the balance in full every month to avoid interest charges.

5. Let Your Accounts Age, Keep Them Open, Do Not Close

This will not be a quick fix and thus why account age represents a smaller portion of your credit score. One early lesson I learned was that I took the advice of closing credit card accounts in order to avoid putting on more debt. This is not smart advice. From my experience, I have been much better off paying off the credit card, keeping the line open, and never using it again. I have several credit cards that have entered my credit card grave that I know I will never use, but keeping those lines open have positively impacted my credit score numerous times. Keep in mind that some banks will decrease your credit line after your account has been inactive for a couple years.

For those that play the credit card rewards game of opening an account, earning the sign up bonus, and then closing the card, this is only recommended for those who already have a high credit score greater than around 760 and have no plans of taking out a line of credit such as a mortgage or auto loan.

6. Have A Mix of Credit Including Revolving Accounts and Installment Accounts

I have dozens of credit cards even though I only use 2 as my preferred top of wallet, everyday credit cards. However, I used to have a couple auto loans as well. Now that I have become debt free, I no longer have an auto loan. I also have a mortgage for my investment property. The point of having a mix of credit is to show responsibility for various types of credit accounts.

Personally I do not pay attention to the credit mix because I get credit when needed. There are much bigger priorities to focus on when it comes to increasing your credit score.

7. Limit The Number of Credit Inquiries Especially Hard, Credit Pull, Inquiries

The dip you see from October 2020 to November 2020 and especially from November to December is because I had a couple hard inquiries on my credit due to getting a mortgage. There are soft pulls that do not require a credit pull and examples of that could be various credit card sites that will prequalify you for certain credit products. Soft pulls will not impact your credit score, but hard pulls will as you can see in the 30+ point drop.