I wanted to give an introduction to my overall investment approach and start digging into sports cards as my main alternative investment. I provide an overview of my investment buckets, side hustling, and my alternative investments that relies heavily on sports cards.

Before I jump into alternative investments, I will cover the basics of my overall investment buckets and strategy. I want to emphasize that the money I invest is prioritized in 3 investment buckets

The 3 Investment Buckets

- Priority 1: Retirement accounts such as a 401k and Roth IRA

- Priority 2: Taxable accounts such as one through a brokerage account. This is money that you have already paid taxes on and are now investing. This money can be withdrawn at any time. The taxable account bucket is completely separate from my retirement accounts

- Priority 3: Alternative investments

So to be clear unless I have money left over after contributing to priority buckets 1 and 2, I will not contribute new money to my alternative investments.

Like many in this community, I have side hustles and I have a full time job. Let me start with my full time job. Whenever I get my paycheck, everything is automated as much as possible. I like to use the term set it and forget it. I automatically contribute to my retirement accounts so that I always hit my annual retirement contribution limit as a single household. That is priority investment bucket 1.

After bucket 1 is filled, I go onto my second bucket which is my taxable accounts. The reason I have taxable accounts is because based on my monthly expenses and budgeting, I will have money left over to put into my non retirement buckets. After that any additional money goes into the alternative investment bucket.

What Are Alternative Investments and Examples of Alternative Investments

Most alternative investments are not regulated by the SEC and are not as liquid as stocks or cash. Basically it means if I wanted to sell alternative investments, I have to go through more steps and jump through more hoops to convert into cash.

Please note that I am not a financial advisor so please keep that in mind. This is simply my approach to my alternative investment strategy.

The reason I have an alternative investment portfolio is because it is part of my diversification strategy. I have traditional stocks, bonds, and cash. I am also willing to take the higher risk with the potential exponentially higher return.

So what are examples of alternative investments? In many articles, you might come across real estate as being considered alternative investments. That does make sense because real estate is definitely part of a diversification strategy and real estate is not nearly as liquid as other assets. However, for me, I like to keep real estate separate as its own asset class so in other words, I do not consider real estate as part of my alternative investments. Rather, what I consider alternative investments include but are not limited to investments in startups, venture capital, cryptocurrency such as bitcoin, antiques, art, wine, jewelry, precious metals such as gold silver platinum, coins and of course sports cards. Again these are my definitions so this will vary if you look at various articles.

The Percentage of Alternative Investments As Part of My Net Worth

My alternative investment class is a higher percentage of my net worth that I prefer, but this is also a result of the sports cards market being in a bull market state with prices reaching new heights nearly every month. I read that alternative investments should not exceed more than 10% of your net worth so that is the guideline I have been using. In doing my monthly net worth statement, my alternative investments have gradually increased from 15% to sometimes up to 25% of my net worth depending on how the card market is doing, which is way more than I ever thought was possible considering the sports cards journey [link] I went through.

My Alternative Investment Portfolio

My current alternative investments are primarily composed of sports cards, a very small collection of coins, which is a family thing, and bitcoin specifically $BTC. I got into the cryptocurrency game when BTC was around $3,000 and I put in a new position buying into the bitcoin halving event on May 11 or 12. Still bitcoin and the actual coins I have are a very small portion of my alternative investments.

An Introduction to How Sports Cards Fits into My Alternative Investment Strategy

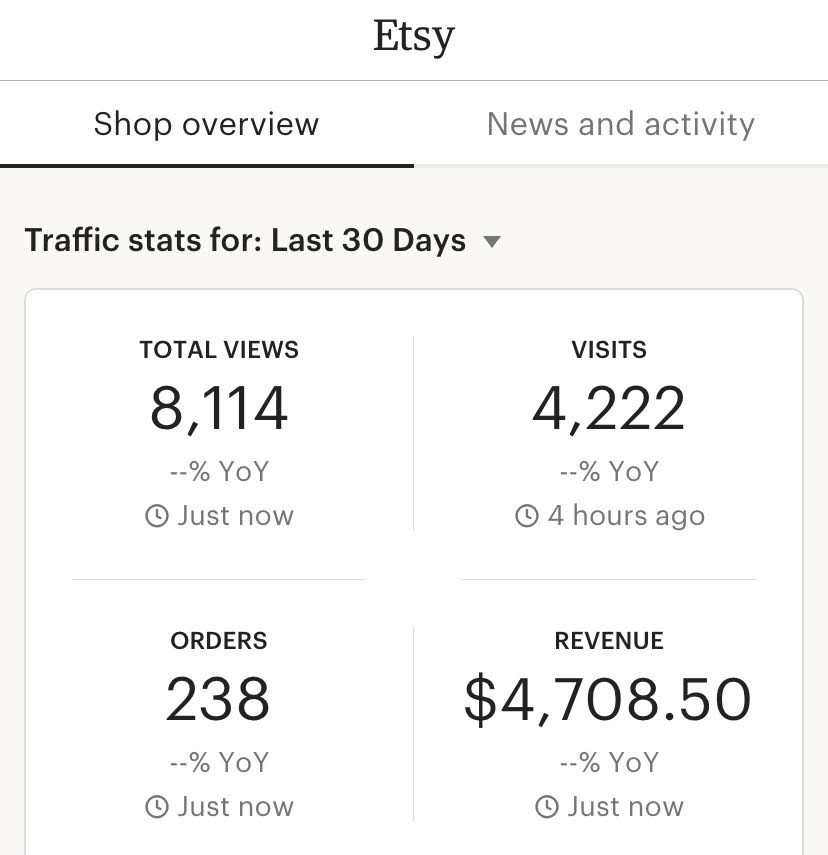

I have a few side hustles and some of the ways I make extra income are real estate, digital marketing consulting, and flipping items including sports cards. I started an Etsy business in August 2020 mainly to give profits to my parents to help pay for their car. The below 30 day stats are as of mid-December 2020. The holiday surge definitely helped!

For now, I am going to talk more about sports cards. The money I make from sports cards results in 3 possible actions:

- I reinvest into sports cards so I can continue buying and selling

- I acquire more cards whether it is money made from the side hustle or money left over from my paycheck after contributing to my two buckets, which are retirement accounts and taxable accounts. The cards I acquire are the ones that I consider as part of my alternative investments. Those cards are the ones I am fairly certain and confident that these will continue to go up in value as well as demand. Some examples include a 1986/87 Fleer Michael Jordan rookie card (RC) both the standard RC and the sticker RC. For example, I was buying the standard RC in PSA 8 and BGS 8.5 grades cards for $1,400 each only a few years ago and as of this writing, these cards are approaching 6,000 each. I was buying the Jordan sticker RC in BGS 6-7.5 for about $125 each and now they are approaching $700 each. These are the cards I hold long term, minimum 3 years if not minimum 5 years.

- The money I make from sports cards will not go into either reinvesting into sports cards or acquiring cards for the long term hold, but rather I will take that money and put it into my retirement account or taxable account.

In the next OMG My Money podcast episode 5, I will explain why sports cards are my favorite alternative investment class.

To wrap this one up, here is a motivational quote by the great Vince Lombardi

“Perfection is not attainable, but if we chase perfection we can catch excellence.”

If you do not mind supporting the podcast, please share this post or podcast with your network, rate the podcast, review, and subscribe. This helps more than you know.

If you ever have any questions, please reach out to me. I will respond every time. This show is about you and I would love to see this community grow. Let’s learn, improve, inspire and collaborate.