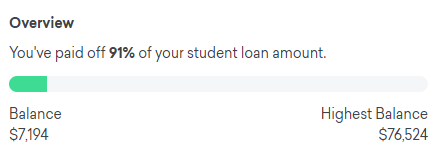

My $77,000 Student Loans Are Fully Paid Off After Defaulting!

I fully paid off $77,000 ($76,524.22 to be exact) in student loans! If you wantRead More…

5 Dumb Excuses I Made For Not Saving Money

I made some dumb financial mistakes in my 20s such as defaulting on my studentRead More…

7 Tips About Using 0% Financing from a Credit Card Marketer

I am sure most of you have come across a 0% financing offer typically whenRead More…

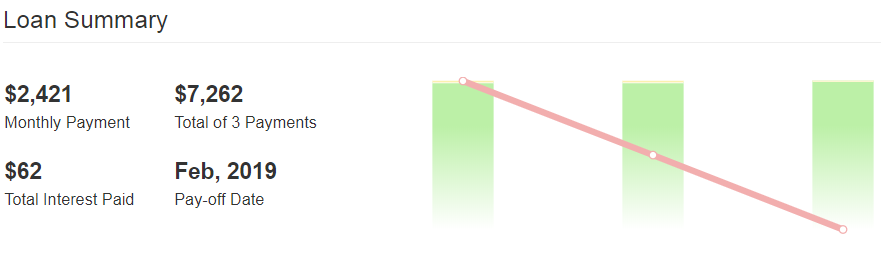

Getting Closer to Paying off My $77,000 Student Loan Debt Payoff December Progress Update

Thanks to a variety of personal finance and side hustle podcasts, I have been motivatedRead More…

7 Reasons You Should Have a Side Hustle to Make Extra Money

Having a side hustle to make more money is a great way to achieve yourRead More…

Pull Your Free Annual Credit Report Before the End of the Year

This is a public service announcement and reminder to pull one of your creditRead More…

4 Things to Look For on Your Credit Report

As the year comes to an end, it is important to take advantage of theRead More…

8 Best Quick and Easy Ebay Optimization Tips For Your Listings

One of my side hustles is buying and selling and naturally, eBay plays a part.Read More…

6 Ways to Build Credit to Improve Your Credit Score

There are some financial “entertainers” who believe that building credit and building your FICO creditRead More…

November 2018 Monthly Side Hustle Extra Income Report

I originally intended for this side hustle extra money report to be monthly but clearlyRead More…

Pros and Cons of Working for A Rideshare Company As a Side Hustle

I am “uber” excited to have this guest post from Lexi Carr. Lexi is a freelanceRead More…

4 Simple Money Advice I Gave to a Colleague in Their 20s

Recently I was talking to a colleague in her 20s and we started to talkRead More…

My 5 Biggest Money Mistakes

I have made some of the worst money mistakes any person can make. It tookRead More…

My $77,000 Student Loan Debt Payoff November Progress Update

Ever since I set my student loan debt payoff goal of March 2019, I haveRead More…

I Knocked Off a Sports Bucket List Item and Went to the World Series Again

I was on a pretty good roll with putting posts up on this blog sinceRead More…

5 Actions I Will Not Be Cheap About

I genuinely believe that if you are just starting to plan for your future whetherRead More…

September 2018 My First Side Hustle Monthly Income Report

I started this blog as a personal journal because I went through some of theRead More…

OMG Favorite Personal Finance Blog Posts of the Week Featuring Debt Experience vs Debt Knowledge, Procrastination, and Ego

For this week I rounded up the following blog posts that I enjoyed reading. OMGRead More…

7 Actions That Can Cost You Time And Money in the Long Run

As I started to spend a couple minutes every month budgeting, I noticed a patternRead More…

My Simple Way of Budgeting and Budget Categories

Earlier this year (May 2018), I had a personal finance epiphany. Out of nowhere IRead More…